Credit Linked Note: A Comprehensive Guide

A credit linked note, often abbreviated as CLN, is a financial instrument that combines the characteristics of a bond and a credit derivative. It is designed to provide investors with exposure to the credit risk of a specific entity while offering the security of a fixed-income investment. In this article, we will delve into the intricacies of credit linked notes, exploring their structure, benefits, risks, and how they are used in the market.

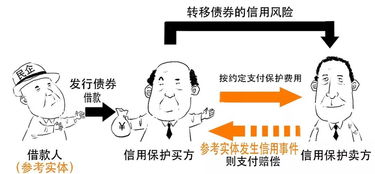

Understanding the Structure of a Credit Linked Note

A credit linked note is essentially a structured product that is backed by the creditworthiness of a reference entity. The reference entity could be a corporation, a government, or even a sovereign entity. The note is issued by a special purpose vehicle (SPV) that is established for the purpose of issuing the note. The SPV then sells the note to investors, who receive periodic interest payments and the principal amount at maturity, provided the reference entity remains creditworthy.

The structure of a credit linked note can be broken down into the following components:

-

Reference Entity: The entity whose credit risk is being referenced. This could be a corporation, a government, or a sovereign entity.

-

Notional Amount: The principal amount of the note, which is typically fixed at the time of issuance.

-

Coupon Rate: The interest rate paid to investors on the notional amount. This rate is usually fixed or variable, depending on the terms of the note.

-

Maturity Date: The date on which the principal amount is repaid to investors.

-

Trigger Event: An event that would cause the credit risk of the reference entity to deteriorate significantly, such as a credit rating downgrade or default.

Benefits of Investing in Credit Linked Notes

Investing in credit linked notes offers several benefits, making them an attractive option for investors seeking exposure to credit risk:

-

Fixed-Income Exposure: Credit linked notes provide investors with a fixed-income component, as they receive periodic interest payments and the principal amount at maturity.

-

Credit Risk Exposure: Investors can gain exposure to the credit risk of a specific entity without owning the underlying assets or equity.

-

Enhanced Yield Potential: Credit linked notes often offer higher yields compared to traditional bonds, as they compensate investors for taking on additional credit risk.

-

Customizable Structure: The structure of a credit linked note can be tailored to meet the specific needs of investors, allowing for various risk and return profiles.

Risks Associated with Credit Linked Notes

While credit linked notes offer several benefits, they also come with certain risks that investors should be aware of:

-

Credit Risk: The most significant risk associated with credit linked notes is the credit risk of the reference entity. If the reference entity experiences financial distress or defaults, the value of the note may be significantly impaired.

-

Market Risk: Credit linked notes are subject to market risk, as the value of the note can be affected by changes in interest rates, credit spreads, and other market factors.

-

Liquidity Risk: Credit linked notes may be less liquid compared to traditional bonds, making it challenging for investors to exit their positions quickly if needed.

-

Counterparty Risk: The risk that the SPV or the counterparty to the note may default on its obligations, leading to potential losses for investors.

How Credit Linked Notes Are Used in the Market

Credit linked notes are used by various market participants for different purposes:

-

Investors: Investors use credit linked notes to gain exposure to credit risk while enjoying the benefits of fixed-income investments.

-

Corporations: Corporations may issue credit linked notes to raise capital while transferring the credit risk to investors.

-

Investment Banks: Investment banks act as intermediaries in the issuance and trading of credit linked notes, facilitating the flow of capital in the market.

-

Insurance Companies: Insurance companies may use credit linked notes as a means to diversify their investment portfolios and gain exposure to credit risk.

Table 1: Comparison of Credit Linked Notes with Traditional Bonds