Understanding the Crypto Market Cap: A Detailed Overview

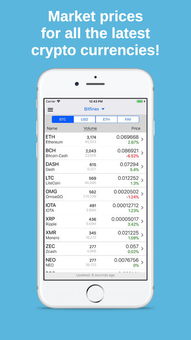

When diving into the world of cryptocurrencies, one term that often comes up is “market cap.” But what exactly does it mean, and how does it influence the crypto market? Let’s explore this concept in detail, using real-time data and information to provide you with a comprehensive understanding.

What is Market Cap?

Market cap, short for market capitalization, is a measure of the total value of a cryptocurrency’s circulating supply. It’s calculated by multiplying the current price of the cryptocurrency by the number of coins in circulation. This figure gives you an idea of how much the entire supply of a particular cryptocurrency is worth in the market.

Calculating Market Cap

Calculating market cap is relatively straightforward. For example, let’s take Bitcoin (BTC), the world’s largest cryptocurrency by market cap. As of the latest data, Bitcoin’s price is $30,000, and there are approximately 18.9 million BTC in circulation. To find the market cap, you simply multiply the price by the number of coins:

| Price | Number of Coins | Market Cap |

|---|---|---|

| $30,000 | 18,900,000 | $570,000,000,000 |

As you can see, Bitcoin’s market cap is currently around $570 billion. This figure can fluctuate rapidly due to changes in the cryptocurrency’s price and the number of coins in circulation.

Importance of Market Cap

Market cap is an essential metric for several reasons:

-

Market Size: It gives you an idea of the size of the cryptocurrency market and its potential for growth.

-

Investment Opportunities: A higher market cap often indicates a more established and stable cryptocurrency, which may be more attractive to investors.

-

Market Influence: Cryptocurrencies with a high market cap can have a significant impact on the overall market, influencing prices and trends.

Market Cap vs. Price

While market cap and price are related, they are not the same thing. Market cap is a measure of the total value of a cryptocurrency, while price is the current value of a single unit of that cryptocurrency. For example, if Bitcoin’s price increases from $30,000 to $35,000, its market cap will also increase, but by a different amount. This is because the market cap is influenced by the total number of coins in circulation, not just the price.

Market Cap Distribution

The crypto market is highly fragmented, with thousands of different cryptocurrencies available. The distribution of market cap among these cryptocurrencies can provide valuable insights:

-

Top 10 Cryptocurrencies: As of the latest data, the top 10 cryptocurrencies account for over 70% of the total market cap. This includes Bitcoin, Ethereum, Binance Coin, Cardano, and others.

-

Mid-Cap and Small-Cap Cryptocurrencies: These cryptocurrencies have market caps ranging from $1 billion to $10 billion and $100 million to $1 billion, respectively. They often offer more diversification and potential for growth but come with higher risks.

-

Altcoins: Altcoins are cryptocurrencies other than Bitcoin. They can have market caps ranging from a few hundred thousand to a few billion dollars. Many altcoins are speculative and can be highly volatile.

Market Cap Trends

The crypto market is known for its volatility, and market cap trends can change rapidly. Some factors that influence market cap trends include:

-

Market Sentiment: Positive news or developments can lead to an increase in market cap, while negative news can cause it to drop.

-

Regulatory Changes: New regulations or changes in existing regulations can impact the market cap of certain cryptocurrencies.

-

Technological Advancements: Innovations in blockchain technology or other related fields can drive up the market cap of certain cryptocurrencies.

Conclusion

Understanding the crypto market cap is crucial for anyone interested in investing or staying informed about the cryptocurrency market. By analyzing market cap