Link Your Bank Account to Nova Credit Screening: A Comprehensive Guide

Managing your finances and creditworthiness can be a daunting task, especially when you’re new to the country or trying to establish your credit history. Nova Credit offers a unique solution by allowing you to link your bank account for a more accurate credit assessment. In this detailed guide, we’ll explore the benefits, process, and considerations of linking your bank account to Nova Credit screening.

Understanding Nova Credit

Nova Credit is a credit reporting service that helps immigrants and expatriates establish their credit history in the United States. By analyzing your financial data, Nova Credit can provide a credit score that reflects your creditworthiness, even if you don’t have a traditional credit history.

Benefits of Linking Your Bank Account

Linking your bank account to Nova Credit offers several advantages:

-

More Accurate Credit Score: Nova Credit uses your bank account information to provide a more comprehensive credit assessment, which can result in a more accurate credit score.

-

Streamlined Application Process: By linking your bank account, you can save time and effort during the application process, as Nova Credit can access your financial data directly.

-

Improved Credit Opportunities: A more accurate credit score can help you qualify for better credit card offers, loans, and other financial products.

How to Link Your Bank Account to Nova Credit

Linking your bank account to Nova Credit is a straightforward process:

-

Sign up for a Nova Credit account: Visit the Nova Credit website and create an account by providing your basic information, such as your name, date of birth, and email address.

-

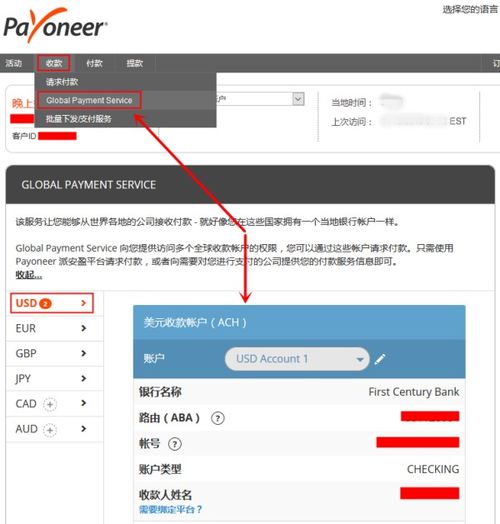

Link your bank account: Once you’ve created your account, navigate to the “Link Bank Account” section. Enter your bank account details, including your account number and routing number.

-

Verify your account: Nova Credit will send a small deposit to your bank account. Once you receive the deposit, log in to your Nova Credit account and enter the amount to verify your account.

-

Access your credit score: After your account is verified, Nova Credit will provide you with a credit score and credit report based on your financial data.

Considerations Before Linking Your Bank Account

Before linking your bank account to Nova Credit, consider the following:

-

Privacy and Security: Ensure that you trust Nova Credit with your financial information. Review their privacy policy and security measures to ensure your data is protected.

-

Account Access: Make sure you have access to your bank account online or through a mobile app, as you’ll need to verify your account by entering the small deposit amount.

-

Account Activity: Nova Credit will analyze your bank account activity to determine your creditworthiness. Be prepared to provide explanations for any unusual transactions or account activity.

Comparing Nova Credit with Other Credit Reporting Services

While Nova Credit is a valuable tool for establishing credit, it’s essential to compare it with other credit reporting services:

| Service | Benefits | Drawbacks |

|---|---|---|

| Nova Credit | Accurate credit score for immigrants and expatriates, easy to use | May not include all financial accounts, limited availability |

| TransUnion | Comprehensive credit report, widely recognized | May not be as accurate for immigrants and expatriates |

| Equifax | Comprehensive credit report, widely recognized | May not be as accurate for immigrants and expatriates |

| Experian | Comprehensive credit report, widely recognized | May not be as accurate for immigrants and expatriates |

Conclusion

Linking your bank account to Nova Credit can be a valuable step in