Chase Link Accounts: A Comprehensive Guide

Managing multiple bank accounts can be a hassle, but with Chase Link Accounts, you can streamline your banking experience. In this detailed guide, we’ll explore the various aspects of Chase Link Accounts, including how they work, their benefits, and how to set them up.

Understanding Chase Link Accounts

Chase Link Accounts allow you to link your Chase accounts together, giving you a unified view of your finances. This means you can easily transfer funds between your checking, savings, and credit card accounts, as well as view your transactions in one place.

How Chase Link Accounts Work

When you link your accounts, Chase will create a single account number for each linked account. This account number will be used for all transactions and inquiries, making it easier to manage your finances. Here’s a step-by-step guide on how to link your accounts:

- Log in to your Chase online banking account.

- Click on the “Manage Accounts” tab.

- Select the “Link Accounts” option.

- Enter the account numbers and routing numbers for the accounts you want to link.

- Follow the prompts to complete the linking process.

Once your accounts are linked, you can easily transfer funds between them by selecting the “Transfer Money” option in the “Manage Accounts” tab.

Benefits of Chase Link Accounts

Linking your accounts offers several benefits, including:

- Convenience: Access all your accounts in one place, making it easier to manage your finances.

- Efficiency: Transfer funds between accounts quickly and easily.

- Transparency: View all your transactions in one place, giving you a clear picture of your financial situation.

- Security: Chase uses advanced security measures to protect your linked accounts.

Chase Link Accounts vs. Chase QuickPay

It’s important to note that Chase Link Accounts are different from Chase QuickPay. While both allow you to transfer funds between accounts, Chase QuickPay is specifically designed for sending money to friends and family. Here’s a comparison of the two:

| Feature | Chase Link Accounts | Chase QuickPay |

|---|---|---|

| Account Linking | Yes | No |

| Transfer Limits | Varies by account type | $2,500 per day |

| Recipient Type | Chase accounts only | Chase and non-Chase accounts |

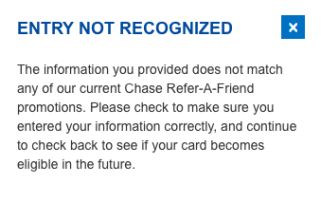

Setting Up Chase Link Accounts

Setting up Chase Link Accounts is a straightforward process. Here’s what you’ll need to do:

- Have a Chase checking, savings, or credit card account.

- Access your Chase online banking account.

- Follow the steps outlined in the “How Chase Link Accounts Work” section.

Keep in mind that you can only link Chase accounts. If you have accounts with other banks, you’ll need to use their respective online banking platforms to manage those accounts.

Chase Link Accounts: Pros and Cons

Like any financial product, Chase Link Accounts have their pros and cons:

Pros

- Easy to set up and use

- Streamlines your banking experience

- Enhances security with advanced measures

Cons

- Can only link Chase accounts

- May require additional verification steps for certain transactions

Conclusion

Chase Link Accounts offer a convenient and secure way to manage your Chase accounts. By linking your accounts, you can easily transfer funds, view your transactions, and stay on top of your finances. If you’re a Chase customer looking to streamline your banking experience, Chase Link Accounts may