Actual Budget Link Transaction to Schedule: A Comprehensive Guide

Managing finances effectively is crucial for any business or individual. One of the key aspects of financial management is linking actual budget transactions to a schedule. This process ensures that you stay on track with your financial goals and can make informed decisions based on real-time data. In this article, we will delve into the various dimensions of linking actual budget transactions to a schedule, providing you with a comprehensive guide to help you master this essential skill.

Understanding the Basics

Before we dive into the details, let’s clarify what we mean by “actual budget link transaction to schedule.” This process involves connecting the actual financial transactions that occur within a business or individual’s budget to a predetermined schedule. This schedule can be monthly, quarterly, or annually, depending on your financial planning needs.

By linking these transactions to a schedule, you can easily track your spending, revenue, and overall financial performance. This allows you to identify trends, make adjustments, and stay on top of your financial health.

Step-by-Step Guide to Linking Actual Budget Transactions to a Schedule

Now that we have a basic understanding of the concept, let’s explore the steps involved in linking actual budget transactions to a schedule:

-

Set up a budget: Begin by creating a comprehensive budget that outlines your income, expenses, and financial goals. This budget should be realistic and tailored to your specific needs.

-

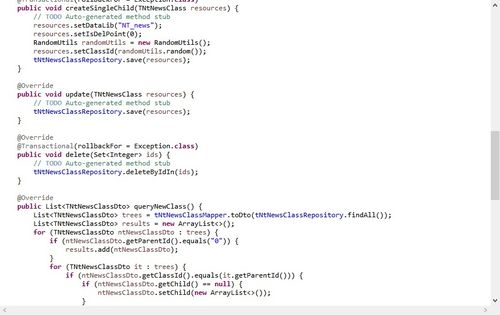

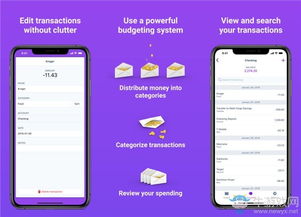

Choose a scheduling tool: Select a scheduling tool that suits your needs. This could be a spreadsheet, a budgeting app, or a specialized software program.

-

Enter your budget details: Input your budget categories, income sources, and expense items into the scheduling tool.

-

Record actual transactions: As you incur expenses or receive income, record these transactions in your scheduling tool. Ensure that you categorize each transaction accurately.

-

Compare actuals to budget: Regularly compare your actual financial transactions to your budgeted amounts. This will help you identify any discrepancies and take corrective actions if necessary.

-

Adjust your budget: Based on your actual financial performance, make adjustments to your budget as needed. This may involve reallocating funds, setting new financial goals, or revising your spending habits.

Benefits of Linking Actual Budget Transactions to a Schedule

Linking actual budget transactions to a schedule offers several benefits, including:

-

Improved financial visibility: By tracking your actual financial transactions, you gain a clearer picture of your financial health and can make more informed decisions.

-

Enhanced budgeting accuracy: Regularly comparing actuals to budgeted amounts helps you identify trends and make more accurate financial forecasts.

-

Increased accountability: Linking transactions to a schedule holds you accountable for your financial decisions and helps you stay on track with your goals.

-

Reduced financial stress: By managing your finances effectively, you can reduce the stress associated with financial uncertainty and make more confident financial choices.

Best Practices for Successful Budgeting

Here are some best practices to help you successfully link actual budget transactions to a schedule:

-

Stay organized: Keep your budgeting records up-to-date and well-organized. This will make it easier to track your financial transactions and make adjustments as needed.

-

Set realistic goals: Establish achievable financial goals that align with your values and priorities.

-

Review your budget regularly: Regularly review your budget to ensure that it remains relevant and reflects your current financial situation.

-

Seek professional advice: If you’re struggling to manage your finances, consider seeking advice from a financial advisor or accountant.

Real-World Examples

Let’s take a look at a few real-world examples of how businesses and individuals have successfully linked actual budget transactions to a schedule:

| Business | Industry | Outcome |

|---|---|---|

| XYZ Corporation | Technology | Increased revenue by 15% through better financial management and budgeting. |