Understanding the Aadhaar Linking Process

Are you aware of the importance of linking your Aadhaar card with your PAN card? If not, you’re not alone. Many individuals in India still find this process confusing and overwhelming. In this article, we will delve into the details of Aadhaar linking to PAN card, helping you understand its significance, the process, and the benefits it offers.

What is Aadhaar Linking?

Aadhaar linking is the process of associating your Aadhaar card with other government documents, such as your PAN card. This linkage ensures that your personal information is accurate and up-to-date across various government databases. It helps in preventing identity theft and ensures that you receive the benefits and services you are entitled to.

Why Link Aadhaar to PAN Card?

Linking your Aadhaar card to your PAN card is mandatory under the Income Tax Act, 1961. Here are some of the reasons why this linkage is crucial:

-

Prevents duplicate PAN cards: Linking your Aadhaar card to your PAN card ensures that you do not have multiple PAN cards, which can lead to legal issues.

-

Streamlines tax compliance: With Aadhaar linked to your PAN card, you can easily file your income tax returns and avail various tax benefits.

-

Facilitates e-KYC: Linking your Aadhaar card to your PAN card enables you to complete the e-KYC process for various financial services, such as opening a bank account or applying for a credit card.

-

Prevents tax evasion: By linking your Aadhaar card to your PAN card, the government can better track your financial transactions and ensure that you comply with tax regulations.

How to Link Aadhaar to PAN Card

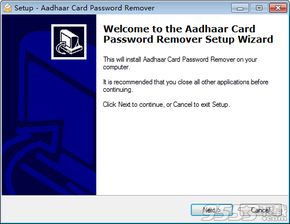

Linking your Aadhaar card to your PAN card is a straightforward process. Here’s a step-by-step guide:

-

Visit the Income Tax Department’s e-Filing website.

-

Log in to your account using your PAN card and password.

-

Select “Link Aadhaar” from the menu.

-

Enter your Aadhaar number and the captcha code displayed on the screen.

-

Enter your mobile number and email address to receive an OTP (One-Time Password).

-

Enter the OTP received on your mobile number or email address.

-

Review the details and submit the request.

Documents Required for Aadhaar Linking

While linking your Aadhaar card to your PAN card, you may need to provide the following documents:

-

Aadhaar card

-

PAN card

-

Proof of identity and address (if the details on your Aadhaar card are different from those on your PAN card)

Benefits of Aadhaar Linking

Linking your Aadhaar card to your PAN card offers several benefits, including:

-

Enhanced security: By linking your Aadhaar card to your PAN card, you can ensure that your personal information is secure and protected.

-

Reduced paperwork: With Aadhaar linking, you can minimize the need for physical documents and streamline your tax compliance process.

-

Access to government services: Linking your Aadhaar card to your PAN card enables you to access various government services and benefits more easily.

Common Issues and Solutions

While linking your Aadhaar card to your PAN card, you may encounter some issues. Here are some common problems and their solutions:

-

Problem: You are unable to link your Aadhaar card to your PAN card.

-

Solution: Ensure that you have entered the correct Aadhaar number and PAN card number. If the issue persists, contact the Income Tax Department’s customer care.

-

Problem: You receive an error message while linking your Aadhaar card to your PAN card.

-

Solution: Check your internet connection and try again.