Link Crypto Predictions: A Comprehensive Overview

Are you intrigued by the world of cryptocurrencies and looking to make informed predictions? Link crypto predictions have become increasingly popular as the digital currency market continues to evolve. In this detailed guide, we will explore various aspects of crypto predictions, including historical trends, technical analysis, fundamental analysis, and future outlooks. By the end, you’ll have a better understanding of how to make well-informed predictions in the crypto market.

Understanding Crypto Predictions

Crypto predictions involve analyzing historical data, market trends, and other factors to forecast the future price movements of cryptocurrencies. These predictions can help you make informed decisions about buying, selling, or holding digital assets. However, it’s important to note that crypto markets are highly volatile, and predictions are not guaranteed to be accurate.

Historical Trends

One of the most crucial aspects of crypto predictions is analyzing historical trends. By examining past price movements, you can identify patterns and potential future trends. Here’s a breakdown of some key historical trends in the crypto market:

| Year | Market Cap | Bitcoin Price |

|---|---|---|

| 2013 | $12 billion | $1,100 |

| 2017 | $800 billion | $20,000 |

| 2020 | $1.2 trillion | $10,000 |

| 2021 | $2.2 trillion | $65,000 |

As you can see, the crypto market has experienced significant growth over the years, with Bitcoin leading the charge. However, it’s important to note that these trends are not always linear, and there have been periods of extreme volatility.

Technical Analysis

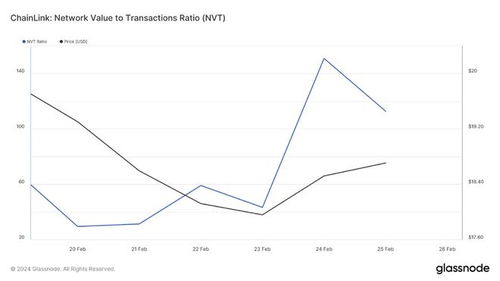

Technical analysis is a popular method for crypto predictions, involving the study of historical price and volume data to identify patterns and trends. Here are some key technical analysis tools and indicators:

- Price Charts: Analyzing the price charts of cryptocurrencies can help you identify trends, support and resistance levels, and potential entry and exit points.

- Volume Analysis: Examining trading volume can provide insights into market sentiment and potential price movements.

- Technical Indicators: Tools like moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) can help you make more informed predictions.

By combining these tools and indicators, you can gain a better understanding of the crypto market and make more accurate predictions.

Fundamental Analysis

In addition to technical analysis, fundamental analysis is another crucial aspect of crypto predictions. This involves evaluating the intrinsic value of a cryptocurrency based on various factors, such as market supply, demand, and technological advancements. Here are some key fundamental analysis factors:

- Market Supply: The total number of coins in circulation can impact the value of a cryptocurrency.

- Market Demand: High demand for a cryptocurrency can drive its price up, while low demand can lead to a decline.

- Technological Advancements: Innovations in blockchain technology and the development of new use cases can positively impact a cryptocurrency’s value.

By staying informed about these factors, you can make more informed predictions about the future value of cryptocurrencies.

Future Outlooks

When making crypto predictions, it’s important to consider future outlooks. This involves analyzing market trends, regulatory news, and other factors that could impact the crypto market. Here are some key factors to consider:

- Market Trends: Keep an eye on the overall market trends, as they can influence the price of individual cryptocurrencies.

- Regulatory News: Changes in regulations can have a significant impact on the crypto market, so stay informed about any news related to crypto regulations.

- Technological Advancements: Innovations in blockchain technology and the development of new use cases can drive