Crypto Link Bank Account: A Comprehensive Guide

Are you considering linking your crypto assets to a traditional bank account? If so, you’ve come to the right place. In this detailed guide, we’ll explore the ins and outs of crypto link bank accounts, their benefits, and how they can enhance your financial management. Let’s dive in.

What is a Crypto Link Bank Account?

A crypto link bank account is a financial service that allows you to link your cryptocurrency wallet to a traditional bank account. This enables you to easily transfer funds between your crypto assets and your fiat currency, making it more convenient to manage your finances.

How Does It Work?

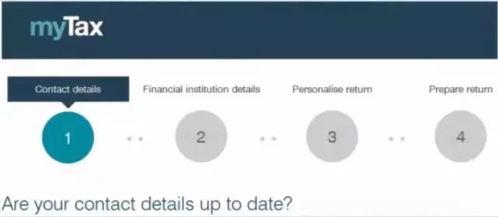

Linking your crypto wallet to a bank account is a straightforward process. Here’s a step-by-step guide:

- Choose a crypto link bank account provider. Some popular options include Coinbase, Gemini, and BlockFi.

- Open an account with the provider and complete the necessary verification process.

- Link your crypto wallet to the bank account by providing the necessary wallet address and account details.

- Transfer funds between your crypto wallet and bank account as needed.

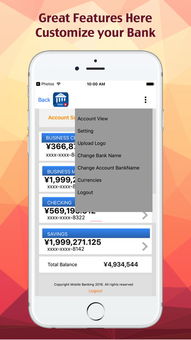

Once linked, you can access your crypto assets through the bank account’s online platform or mobile app, making it easier to manage your finances and make purchases.

Benefits of a Crypto Link Bank Account

There are several benefits to using a crypto link bank account:

- Convenience: Easily access your crypto assets and make purchases using fiat currency.

- Security: Your crypto assets are stored in a secure wallet, reducing the risk of theft or loss.

- Transparency: Track your transactions and manage your finances more effectively.

- Accessibility: Access your crypto assets from anywhere in the world, as long as you have an internet connection.

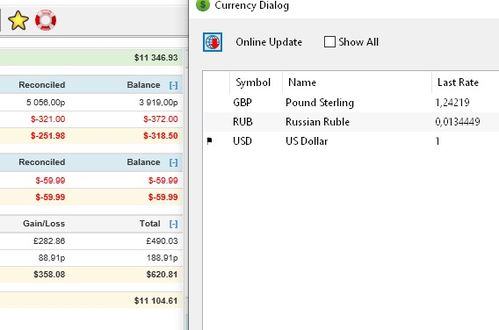

Understanding Fees and Limits

Before linking your crypto wallet to a bank account, it’s important to understand the fees and limits associated with the service. Here’s a breakdown of some common fees and limits:

| Fee Type | Description | Example |

|---|---|---|

| Transfer Fee | Fee charged for transferring funds between your crypto wallet and bank account. | $5 – $10 per transaction |

| Withdrawal Fee | Fee charged for withdrawing funds from your bank account to a crypto wallet. | $10 – $20 per withdrawal |

| Monthly Fee | Fee charged for using the crypto link bank account service. | $5 – $10 per month |

| Minimum Balance | Minimum amount required to maintain your account. | $100 – $500 |

| Maximum Withdrawal Limit | Maximum amount you can withdraw from your bank account in a given period. | $1,000 – $5,000 per day |

It’s important to review the fees and limits associated with your chosen provider to ensure they align with your financial goals and needs.

Choosing the Right Provider

When selecting a crypto link bank account provider, consider the following factors:

- Security: Ensure the provider has robust security measures in place to protect your assets.

- Reputation: Research the provider’s reputation and customer reviews.

- Customer Support: Look for a provider with reliable customer support to assist you with any issues.

- Features: Consider the features offered by the provider, such as interest rates on savings accounts or access to additional financial services.

Conclusion

Linking your crypto wallet to a bank account can provide numerous benefits, including convenience, security, and accessibility. By understanding the process, fees, and limits, you can make an informed decision when