Crypto Coins Linked to Ethereum: A Comprehensive Overview

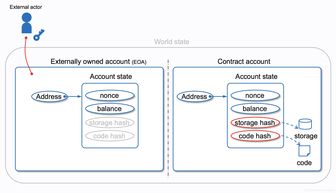

When it comes to the world of cryptocurrencies, Ethereum has emerged as a cornerstone platform, fostering a thriving ecosystem of digital assets. One such category is crypto coins linked to Ethereum. These coins are built on the Ethereum blockchain, leveraging its robust infrastructure and smart contract capabilities. In this detailed exploration, we delve into the various dimensions of crypto coins linked to Ethereum, including their origins, functionalities, and potential future developments.

Origins of Crypto Coins Linked to Ethereum

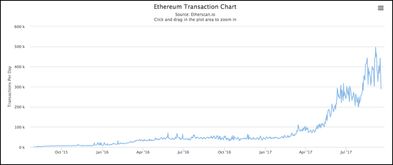

The concept of crypto coins linked to Ethereum can be traced back to the early days of the Ethereum network. As Ethereum gained popularity, developers and entrepreneurs recognized its potential for creating decentralized applications (DApps) and tokens. This led to the creation of numerous projects that built their own coins on the Ethereum blockchain, often referred to as ERC-20 or ERC-721 tokens.

One of the first notable examples is OmiseGO, a platform designed to facilitate peer-to-peer value exchange. Launched in 2017, OmiseGO’s OMG token aims to enable seamless transactions across different currencies and payment systems. Another prominent project is Augur, a decentralized prediction market platform that utilizes its own token, REP.

Functionality and Use Cases

Crypto coins linked to Ethereum offer a wide range of functionalities and use cases. Many of these coins are designed to address specific problems or provide unique services within the Ethereum ecosystem. Here are some common functionalities and use cases:

-

Payment Systems: Many crypto coins linked to Ethereum serve as payment systems, enabling users to make transactions across different platforms and currencies. Examples include OmiseGO, Basic Attention Token (BAT), and 0x (ZRX).

-

Decentralized Finance (DeFi): DeFi projects leverage Ethereum’s smart contract capabilities to create decentralized financial services, such as lending, borrowing, and trading. Crypto coins linked to DeFi platforms, such as Uniswap (UNI) and Aave (AAVE), play a crucial role in these services.

-

Tokenization: Some crypto coins linked to Ethereum are used for tokenizing real-world assets, such as real estate, stocks, and commodities. This allows for fractional ownership and easier trading of these assets on the blockchain.

-

Identity and Access Management: Projects like uPort and Civic use crypto coins linked to Ethereum to provide decentralized identity solutions and secure access to digital services.

Market Performance

The market performance of crypto coins linked to Ethereum can vary significantly. Some tokens have experienced exponential growth, while others have struggled to maintain value. Below is a table showcasing the market capitalization of some popular Ethereum-based tokens as of [insert date]. Please note that these figures are subject to change:

| Token | Market Capitalization |

|---|---|

| Uniswap (UNI) | $[insert value] |

| Aave (AAVE) | $[insert value] |

| Chainlink (LINK) | $[insert value] |

| Tezos (XTZ) | $[insert value] |

Future Developments

The future of crypto coins linked to Ethereum looks promising, with several key developments on the horizon:

-

Ethereum 2.0: The upcoming Ethereum 2.0 upgrade aims to improve scalability, security, and sustainability of the network. This could lead to increased adoption of Ethereum-based tokens and projects.

-

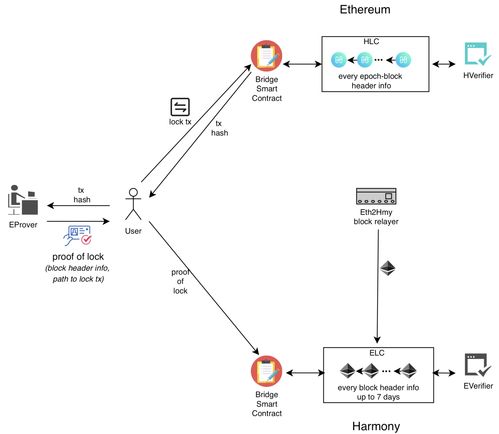

Interoperability: Efforts are being made to enhance interoperability between different blockchains, including Ethereum. This could open up new opportunities for cross-chain projects and tokens.

-

Regulatory Environment: As the regulatory landscape continues to evolve, crypto coins linked to Ethereum may face increased scrutiny. However, this could also lead to greater mainstream adoption and stability.

In conclusion, crypto coins linked to Ethereum offer a diverse range of functionalities and use cases, contributing to the growth and development of the Ethereum ecosystem. As the platform continues to evolve and gain wider adoption, these tokens have the potential to play a significant role in the future of digital finance.